[ad_1]

If you’re having trouble obtaining a home loan, perhaps after speaking to multiple banks, lenders and even a mortgage broker, consider reaching out to a “portfolio lender.”

Simply put, portfolio lenders keep the loans they originate (instead of selling them off to investors), which gives them added flexibility when it comes to underwriting guidelines.

As such, they might be able to offer unique solutions others cannot, or they could have a special loan program not found elsewhere.

For example, a portfolio lender may be willing to originate a no-down payment mortgage while others are only able to provide a loan up to 97% loan-to-value (LTV).

Or they could be more forgiving when it comes to marginal credit, a high DTI ratio, limited documentation, or any other number of issues that could block you from obtaining a mortgage via traditional channels.

What Is a Portfolio Loan?

- A home loan kept on the bank’s books as opposed to being sold off to investors

- May come with special terms or features that other banks/lenders don’t offer

- Such as no down payment requirement, an interest-only feature, or a unique loan term

- Can also be useful for borrowers with hard-to-close loans who may have been denied elsewhere

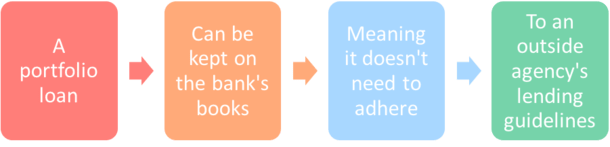

In short, a “portfolio loan” is one that is kept in the bank or mortgage lender’s portfolio, meaning it isn’t sold off on the secondary market shortly after origination.

This allows these lenders to take on greater amounts of risk, or finance loans that are outside the traditional “credit box” because they don’t need to adhere to specific underwriting criteria.

Nowadays, most home loans are backed by Fannie Mae or Freddie Mac, collectively known as the government-sponsored enterprises (GSEs). Or they’re government loans backed by the FHA, USDA, or VA.

All of these agencies have very specific underwriting standards that must be met, whether it’s a minimum FICO score of 620 for a conforming loan. Or a minimum down payment of 3.5% for an FHA loan.

If these conditions aren’t met, the loans can’t be packaged as agency mortgage-backed securities (MBS) and delivered and sold.

Since small and mid-sized lenders often don’t have the capacity to keep the loans they fund, they must ensure the mortgages they underwrite meet these criteria.

As a result, you have a lot of lenders making plain, vanilla loans that you could get just about anywhere. The only real difference might be pricing and service.

On the other hand, portfolio lenders who aren’t beholden to anyone have the ability to make up their own rules and offer unique loan programs as they see fit.

After all, they’re keeping the loans and taking the risk, so they don’t need to answer to a third party agency or investor.

This means they can offer home loans to borrowers with 500 FICO scores, loans without traditional documentation, or utilize underwriting based on rents (DSCR loans).

Ultimately, they can create their own lending menu based on their very own risk appetite.

Portfolio Loans Can Solve Your Financing Problem

- Large loan amount

- High DTI ratio

- Low credit score

- Recent credit event such as short sale or foreclosure

- Late mortgage payment

- Owner of multiple investment properties

- Asset-based qualification

- Limited or uneven employment history

- Qualifying via subject property’s rental income

- Unique loan program not offered elsewhere such as an ARM, interest-only, zero down, etc.

There are a variety of reasons why you might want/need a portfolio loan.

But it’s generally going to be when your loan doesn’t fit the guidelines of the GSEs (Fannie/Freddie) or Ginnie Mae, which supports the FHA and VA loan programs.

As noted, these types of mortgage lenders can offer things the competition can’t because they’re willing to keep the loans on their books, instead of relying on an investor to buy the loans shortly after origination.

This allows them to offer mortgages that fall outside the guidelines of Fannie Mae, Freddie Mac, the FHA, the VA, and the USDA.

That’s why you might hear that a friend or family member was able to get their mortgage refinanced with Bank X despite having a low credit score or a high LTV.

Or that a borrower was able to get a $5 million jumbo loan, an interest-only mortgage, or something else that might be considered out-of-reach. Perhaps even an ultra-low mortgage rate!

A portfolio loan could also be helpful if you’ve experienced a recent credit event, such as a late mortgage payment, a short sale, or a foreclosure.

Or if you have limited documentation, think a stated income loan or a DSCR loan if you’re an investor.

Really, anything that falls outside the box might be considered by one of these lenders.

Who Offers Portfolio Loans?

Some of the largest portfolio lenders include Chase, U.S. Bank, and Wells Fargo, but there are smaller players out there as well.

Before they failed, First Republic Bank offered special portfolio mortgages to high-net-worth clients that couldn’t be found elsewhere.

They came with below-market interest rates, interest-only periods, and other special features. Ironically, this is what caused them to go under. Their loans were basically too good to be true.

It’s also possible to find a portfolio loan with a local credit union as they tend to keep more of the loans they originate.

For example, many of them offer 100% financing, adjustable-rate mortgages, and home equity lines of credit, while a typical nonbank lender may not offer any of those things.

Generally, portfolio lenders are depositories because they need a lot of capital to fund and hold the loans after origination.

But there are also non-QM lenders out there that offer similar products, which may not actually be held in portfolio because they have their own non-agency investors as well.

Portfolio Loan Interest Rates Can Vary Tremendously

- Portfolio mortgage rates may be higher than rates found with other lenders if the loan program in question isn’t available elsewhere

- This means you may pay for the added flexibility if they’re the only company offering what you need

- Or they could be below-market special deals for customers with a lot of assets

- Either way still take the time to shop around as you would any other type of loan

Now let’s talk about portfolio loan mortgage rates, which can vary widely just like any other type of mortgage rate.

Ultimately, many mortgages originated today are commodities because they tend to fit the same underwriting guidelines of an outside agency like Fannie, Freddie, or the FHA.

As such, the differentiating factor is often interest rate and closing costs, since they’re all basically selling the same thing.

The only real difference aside from that might be customer service, or in the case of a company like Rocket Mortgage, a quirky ad campaign and some unique technology.

For portfolio lenders who offer a truly unique product, loan pricing is entirely up to them, within what is reasonable. This means rates can exhibit a wide range.

If the loan program is higher-risk and only offered by them, expect rates significantly higher than what a typical market rate might be.

But if their portfolio home loan program is just slightly more flexible than what the agencies mentioned above allow, mortgage rates may be comparable or just a bit higher.

It’s also possible for the rate offered to be even more competitive, or below-market, assuming you have a relationship with the bank in question.

It really depends on your particular loan scenario, how risky it is, if others lenders offer similar financing, and so on.

At the end of the day, if the loan you need isn’t offered by other banks, you should go into it expecting a higher rate. But if you can get the deal done, it might be a win regardless.

Who Actually Owns My Home Loan?

- Most home loans are sold to another company shortly after origination

- This means the bank that funded your loan likely won’t service it (collect monthly payments)

- Look out for paperwork from a new loan servicing company after your loan funds

- The exception is a portfolio loan, which may be held and serviced by the originating lender for the life of the loan

Many mortgages today are originated by one entity, such as a mortgage broker or a direct lender, then quickly resold to investors who earn money from the repayment of the loan over time.

Gone are the days of the neighborhood bank offering you a mortgage and expecting you to repay it over 30 years, culminating in you walking down to the branch with your final payment in hand.

Well, there might be some, but it’s now the exception rather than the rule.

In fact, this is part of the reason why the mortgage crisis took place in the early 2000s. Because originators no longer kept the home loans they made, they were happy to take on more risk.

After all, if they weren’t the ones holding the loans, it didn’t matter how they performed, so long as they were underwritten based on acceptable standards. They received their commission for closing the loan, not based on loan performance.

Today, you’d be lucky to have your originating bank hold your mortgage for more than a month. And this can be frustrating, especially when determining where to send your first mortgage payment. Or when attempting to do your taxes and receiving multiple form 1098s.

This is why you have to be especially careful when you purchase a home with a mortgage or refinance your existing mortgage. The last thing you’ll want to do is miss a monthly payment right off the bat.

So keep an eye out for a loan ownership change form in the mail shortly after your mortgage closes.

If your loan is sold, it will spell out the new loan servicer’s contact information, as well as when your first payment to them is due.

[ad_2]

The Truth About Mortgage.com